- Personalized Service

- Compare Offers across Banks

- Doorstep Service

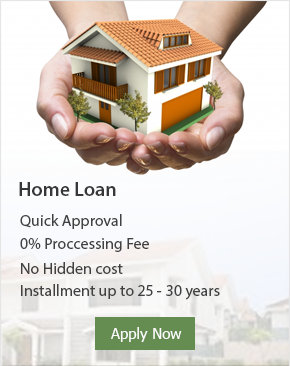

- Personal Loan up to 30 Lakhs

- Loan amount credited to your Bank A/C in 48 hours

- Interest rate start from 12.99%

- Flexible repayment with tenure up to 5 years

- Special interest rate for loan amount above 10 lakhs

- Highly competitive personal loan interest rates

- Special offers, interest rates and charges for Myeasyloan Bank account holders

- Personal loan eligibility in 1 minute available online and across all branches

- Special personal loan offers* for women employees

- Convenience of contacting us through SMS, Webchat, Click2Talk, PhoneBanking and across all branches

- Simplified documentation

- Personal loan disbursal in 2 days*

- Competitive pricing

- Transparency

- Personal loans available for various needs

Compare Interest Rates: Unsecured Loan can be compared primarily on the basis of interest rates which vary across banks depending on your profile which is further linked to your occupation, salary/income, credit history etc and the company that you work with. The personal loan interest rates ranges from 12% to 22%, you must go for that loan which is offering you at the minimum rate.

Evaluation of various Loan offers: You should first calculate the entire loan cost across banks which constitute the rate of interest & other charges. Evaluate offers keeping the tenure of the loan constant & compare the rate of interest, EMIs & other charges. This process will help you get the Best Loan deal.

EMIs: EMI is the monthly equated installment which constitutes the principal amount and the interest on the principal equally divided across each month in the loan tenure. Use our EMI Calculator to compare EMIs across banks

Tenure: Tenure is the time frame for the loan payments to be paid back to the bank; it ranges from 1 year to 5 years. If you have a longer tenure you will end up paying more interest & will have lower EMI, on the other hand shorter loan tenure will carry higher EMIs & the interest amount is less. You must compare the loan offers by keeping the tenure constant.

The Interest Rates vary between 12% and 22% depending on your profile & payment ability. There are basically two types of interest Rates offered by banks which are

- Reducing Balance Interest Rate

- Flat Interest Rate

In the Reducing Interest Rate calculation method, the interest on your loan keeps on reducing as it is calculated on the reduced principle amount which gets reduced daily, monthly, quarterly or annually. Flat Interest Rate calculation method on other hand implies that your rate of interest remains the same & is calculated over the entire loan period. The outstanding loan amount is never reduced over the loan tenure.